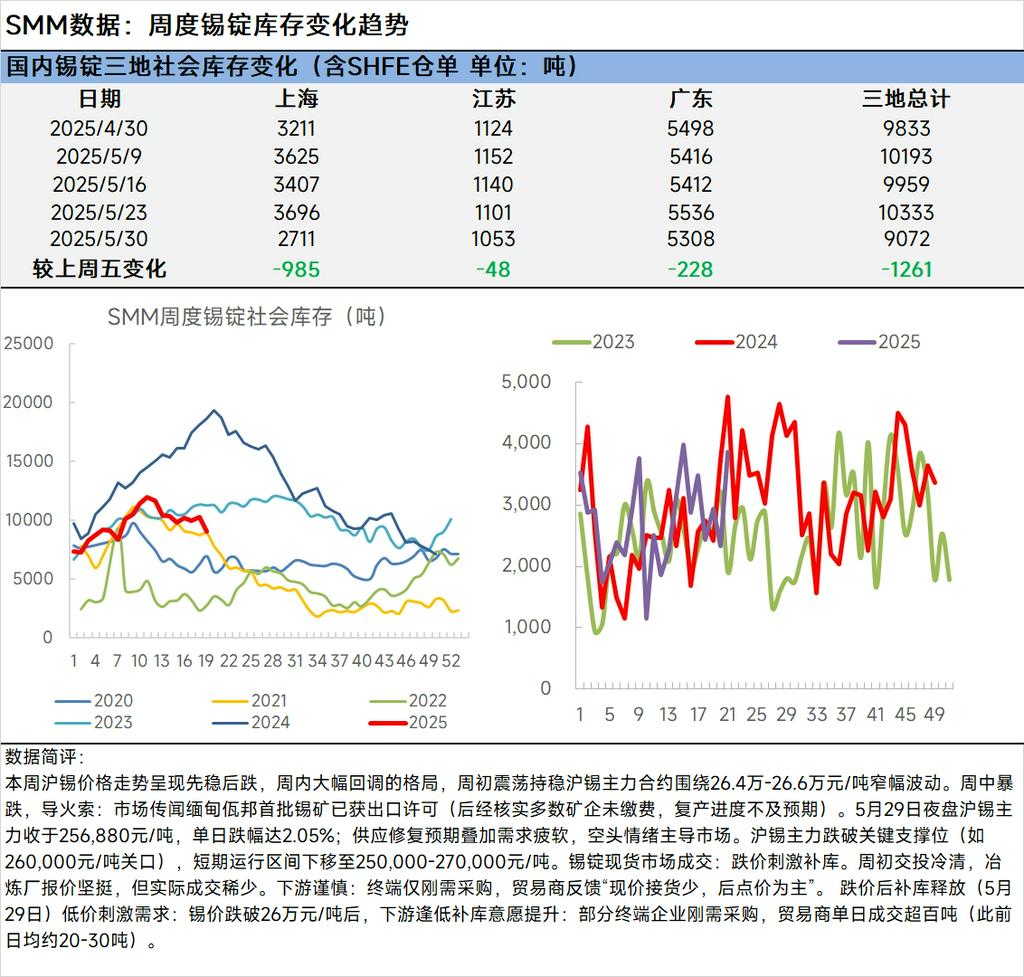

This week, SHFE tin prices initially stabilized before declining, with a significant correction during the week. At the beginning of the week, the most-traded SHFE tin contract fluctuated rangebound around 264,000-266,000 yuan/mt. Mid-week, prices plummeted, triggered by market rumors that the first batch of tin ore from Myanmar's Wa region had obtained export licenses (later verified that most miners had not paid fees, and production resumptions fell short of expectations). On the night session of May 29, the most-traded SHFE tin contract closed at 256,880 yuan/mt, with a daily decline of 2.05%. Expectations of supply recovery, coupled with weak demand, led bears to dominate the market. The most-traded SHFE tin contract fell below key support levels (such as the 260,000 yuan/mt threshold), with the short-term trading range shifting down to 250,000-270,000 yuan/mt. Spot tin ingot market transactions: Price declines stimulated restocking. Trading was sluggish at the beginning of the week, with smelters maintaining firm quotes but actual transactions being scarce. Downstream caution: End-users made just-in-time procurement only, with traders reporting "few spot purchases at current prices, with a focus on deferred pricing." Restocking was released after the price decline (May 29). Low prices stimulated demand: After tin prices fell below 260,000 yuan/mt, downstream restocking willingness increased amid price dips. Some end-user enterprises made just-in-time procurement, with traders achieving over 100 mt in daily transactions (compared to a previous daily average of approximately 20-30 mt).

![The Most-Traded SHFE Tin Contract Opened Lower and Then Traded Stronger, Spot Market Recovers Amid Downtrend [SMM Tin Midday Review]](https://imgqn.smm.cn/usercenter/WWXJU20251217171753.jpg)

![The most-traded SHFE tin contract fluctuated rangebound during the night session, with downstream enterprises mostly following up with small-lot transactions. [SMM Tin Morning Brief]](https://imgqn.smm.cn/usercenter/bYFQn20251217171752.jpg)